Standard Life | Estate Planning with Ideal Segregated Funds Signature 2.0

What is a Death Benefit Guarantee?

A Death Benefit Guarantee is one of the benefits of a segregated fund that is equal to at least 75 per cent (and up to 100 per cent, depending on the contract) of premiums less previous withdrawals 1. It protects the value of your investment if you die. It is paid to someone you name as a beneficiary or to your estate if you do not name one. The level of guarantee may be impacted by the age you are at the time you invest your first premium or the product type you buy. The Death Benefit Guarantee applies if you die before the end of the contract. It pays the greater of: the contract value or the guaranteed amount as per the contract terms. Certain conditions apply.

1 Key facts about segregated fund contracts

Who is it for?

- Clients aged between 65-79 years

- Clients who opened an Ideal Segregated Funds Signature 2.0 contract

- Clients who want to invest a minimum of : $1,000 for non-registered plans and $10,000 for registered retirement income plans

Ideal Segregated Funds Signature 2.0 guarantees are a great estate planning tool.

What are the benefits of Estate Planning with Ideal Segregated Funds Signature 2.0?

- Client’s beneficiaries will receive 100% Death Benefit Guarantee on current and future payments within the same series. (First premium payment to the Ideal Series 75/100 and Ideal Series 100/100 has to be made before age 80).

- There is no equity cap and premium payments after age 80 are allowed.

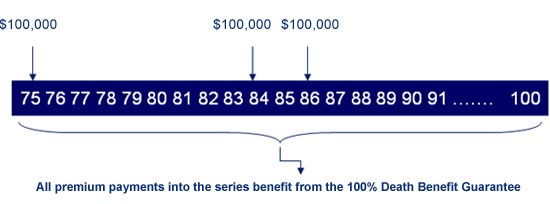

Case study: Jane Rogers: Age 75

Invests $100,000 into a Standard Life Ideal Segregated Funds Signature 2.0 Ideal 75/100 series contract.

At age 84 she sells her home and decides to invest $100,000 of the proceeds into her existing

Ideal Segregated Funds Signature 2.0 contract; this additional premium benefits from a 100% Death Benefit Guarantee.

At age 86, market turmoil makes her worried and she moves her mutual funds to her existing Ideal Segregated Funds Signature 2.0 Ideal 75/100 Series contract. This additional premium payment also benefits from the same 100% Death Benefit Guarantee.

Benefits to the client:

- Peace of Mind: through Maturity and Death Benefit Guarantees* on their investments

- Make sure their legacy goes a long way: Ensure beneficiaries receive income payments instead of lump sum payments using our Gradual Inheritance concept

- Future Planning: Have a place to safe guard their funds when they downsize their home or receive an inheritance

Benefits to advisor:

- Estate Planning Tool

- Account consolidation opportunities

- Providing clients with increased flexibility and options

5 compelling reasons to sell Standard Life’s Ideal Segregated Funds Signature 2.0

- 100% Death Benefit Guarantee* on all premium payments to Ideal 75/100 Series and Ideal 100/100 Series

- Ideal 75/100 & Ideal 100/100 Series under one contract

- No equity limits for Ideal 75/100 and Ideal 100/100 Series

- Platinum Option offers low Management Fees: Ideal Monthly Income Fund MER: 2.15% (estimated figures including insurance fee) **

- Both series are also available in Low Load, No Load, and Back-End Load options.

* First premium payment to Ideal 75/100 Series and Ideal 100/100 Series must be before the annuitant reaches age 80 to benefit from the 100% Death Benefit Guarantee. If the annuitant is age 80 or over at the time of the first premium payment, the Death Benefit Guarantee is 75% for all premiums allocated to the series.

**Based on Ideal 75/100 Series Platinum no-load option (estimated figures). Minimum premium of $250,000 is required per contract for the Platinum no-load option.

(Fund Code: SLI7413S).

Information Folder

Rates & Performance

Reference tool

Ideal 75/100 Series and Ideal 100/100 Series are offered on our Ideal Segregated Funds Signature 2.0 contract, which is an insurance product. Ideal 75/75 Series is also available on our Ideal Segregated Funds Signature 2.0 contract, which offers a 75% maturity/payout benefit guarantee, a 75% death benefit guarantee and 2 investment options. A description of the key features and the terms and conditions of Standard Life’s Ideal Segregated Funds Signature 2.0 is contained in the Information Folder and Contract. Please refer to the section on resets for more information on the rules governing this feature. The information has been simplified for the purposes of this document and, if there are any inconsistencies between the information presented in this document and the Ideal Segregated Funds Signature 2.0 Information Folder and Contract, the Information and Contract will prevail. Subject to any applicable guarantees, any part of the premium or other amount allocated to an Ideal Segregated Fund is invested at the risk of the contractholder and may increase or decrease in value according to fluctuations in the market value of the assets of the Ideal Segregated Fund.

Please let us know if you would like to find out more by clicking below:

- Please send me more information on Ideal Segregated Funds Signature 2.0

- Please send me more information on the Probate Changes

- Call me, I have a case

Your Standard Life Sales Team:

Glenn Ford

Senior Consultant, Investments

519.933.4312

Glenn.Ford@standardlife.ca

Robert Sarkisian

Consultant, Investments

1.800.554.4947 Ext 3412

Robert.Sarkisian@standardlife.ca

Charu Mathur

Senior Sales Associate

1.800.554.4947 Ext 3580

Charu.Mathur@standardlife.ca

Glenn FordSenior Consultant, Investments519.933.4312Glenn.Ford@standardlife.caRobert SarkisianConsultant, Investments1.800.554.4947 Ext 3412 Robert.Sarkisian@standardlife.caCharu MathurSenior Sales Associate1.800.554.4947 Ext 3580Charu.Mathur@standardlife.ca